Our philosophy is all about empowering you to make your own well-informed decisions. Browse through our Education Centre today to super-size your knowledge base today. We’ll be adding to the below archive with time; if you have a topic you would like our Prophets to cover, send us your idea to help@superprophets.com.au today.

Education Centre

Use the links below to learn more!

Super Contributions

There are two types of super contributions:

The contribution caps limit the amount that can be contributed for a member each financial year. The caps are indexed annually. A member whose total contributions in a year exceed the contribution caps may be liable for additional tax on the excess contributions (https://www.ato.gov.au/Individuals/Super/In-detail/Growing-your-super/Super-contributions—too-much-can-mean-extra-tax/)

Concessional

(before-tax) contributions

- Concessional contributions are contributions made into your SMSF that are included in the SMSF’s assessable income. These contributions are taxed in your SMSF at a ‘concessional’ rate of 15%, which is often referred to as ‘contributions tax’.

- The most common types of concessional contributions are employer contributions, such as super guarantee and salary sacrifice contributions. Concessional contributions also include personal contributions made by the member for which the member claims an income tax deduction.

- Concessional contributions are subject to a yearly cap.

- From 1 July 2017, the general concessional contributions cap is $25,000 for all individuals regardless of age.

- For the 2014–15, 2015–16 and 2016–17 financial years, the concessional contributions cap is $30,000 per financial year and is increased to $35,000 for members aged 49 or over.

- For the 2013–14 financial year onwards, excess concessional contributions are no longer subject to excess contributions tax. If a member’s contributions exceed the cap, the amount will be included in the member’s assessable income and taxed at their marginal tax rate.

- From 1 July 2018, members can make ‘carry-forward’ concessional super contributions if they have a total superannuation balance of less than $500,000. Members can access their unused concessional contributions caps on a rolling basis for five years. Amounts carried forward that have not been used after five years will expire.

- The first year in which you can access unused concessional contributions is the 2019–20 financial year.

Non-concessional

(after-tax) contributions

- Generally, non-concessional contributions are contributions made into your SMSF that are not included in the SMSF’s assessable income. The most common type is personal contributions made by the member for which no income tax deduction is claimed.

- For the 2014–15, 2015–16 and 2016–17 financial years non-concessional contributions are subject to a yearly cap of $180,000 for members 65 or over but under 75 or $540,000 over a three-year period for members under 65. If a member’s non-concessional contributions exceed the cap, from 1 July 2017 a tax of 47% is levied on the excess contributions. Individual members are personally liable for this tax and must have their super fund release an amount of money equal to the tax.

- From 1 July 2018, there are changes that affect amounts released from super. A fund may receive a release authority statement to release amounts from super, for example when a member has exceeded their non-concessional contributions cap.

- When a fund receives a valid release authority, it is authorised to release an amount from the member’s super account according to the instructions in the release authority. The fund will send the released money to us. Before we send the balance of the released amount to the member we will offset any ATO or Commonwealth debts.

- Non-concessional contributions also include excess concessional contributions for the financial year. They do not include super co-contributions, structured settlements and orders for personal injury or capital gains tax (CGT) related payments that the member has validly elected to exclude from their non-concessional contributions.

- From 1 July 2017, the non-concessional contributions cap is reduced to $100,000 for members 65 or over but under 75. Members under 65 years of age will have the option of contributing up to $300,000 over a three-year period for members depending on their total superannuation balance.

- The contribution and bring forward available to members under 65 is outlined in the following table:

| Total superannuation balance | Contribution and bring forward available |

| Less than $1.4 million | Access to $300,000 cap (over three years) |

| Greater than or equal to $1.4 million and less than $1.5 million | Access to $200,000 cap (over two years) |

| Greater than or equal to $1.5 million and less than $1.6 million | Access to $100,000 cap (no bring-foward period, general non-concessional contributions cap applies) |

| Greater than or equal to $1.6 million | Nil |

- The total superannuation balance is determined on 30 June of the previous financial year.

- Transitional arrangements apply to individuals who brought forward their non-concessional contributions cap in the 2015–16 or 2016–17 financial years.

What is

salary sacrifice?

Salary sacrifice is an arrangement with your employer to forego part of your salary or wages in return for your employer providing benefits of a similar value.

If you make voluntary super contributions through a salary sacrifice agreement you should be aware of how your contributions will affect your super balance. You can agree with your employer for your voluntary contribution to be in addition to your employer’s compulsory super contribution.

If you are deciding whether you should salary sacrifice some of your income into your super, or if you are already salary sacrificing, you may want to find more information or check your entitlements under the Fair Work Act 2009.

One example of a salary sacrifice arrangement is to have some of your salary or wages paid into your super fund instead of to you.

Salary sacrificed super contributions are classified as employer super contributions, rather than employee contributions. This reduces the amount of super guarantee contributions that your employer is required to make for you, unless the terms of the agreement between you and your employer specify that they continue to pay the minimum super guarantee amount. If you make super contributions through a salary sacrifice agreement, these contributions are taxed in the super fund at a maximum rate of 15%. Generally, this tax rate is less than your marginal tax rate.

The sacrificed component of your total salary package is not counted as assessable income for tax purposes. This means that it is not subject to pay as you go (PAYG) withholding tax.

If salary sacrificed super contributions are made to a complying super fund, the sacrificed amount is not considered a fringe benefit.

For more information, click here.

Transition to

retirement

Salary sacrifice is an arrangement with your employer to forego part of your salary or wages in return for your employer providing benefits of a similar value.

If you make voluntary super contributions through a salary sacrifice agreement you should be aware of how your contributions will affect your super balance. You can agree with your employer for your voluntary contribution to be in addition to your employer’s compulsory super contribution.

If you are deciding whether you should salary sacrifice some of your income into your super, or if you are already salary sacrificing, you may want to find more information or check your entitlements under the Fair Work Act 2009.

One example of a salary sacrifice arrangement is to have some of your salary or wages paid into your super fund instead of to you.

Salary sacrificed super contributions are classified as employer super contributions, rather than employee contributions. This reduces the amount of super guarantee contributions that your employer is required to make for you, unless the terms of the agreement between you and your employer specify that they continue to pay the minimum super guarantee amount. If you make super contributions through a salary sacrifice agreement, these contributions are taxed in the super fund at a maximum rate of 15%. Generally, this tax rate is less than your marginal tax rate.

The sacrificed component of your total salary package is not counted as assessable income for tax purposes. This means that it is not subject to pay as you go (PAYG) withholding tax.

If salary sacrificed super contributions are made to a complying super fund, the sacrificed amount is not considered a fringe benefit.

For more information, click here.

Benefits

Boost your super savings

Your super balance will keep growing as your employer continues to make contributions into your super account. Salary sacrificing some of your pre-tax income into your super will further boost your super savings.

Pay less tax

Employer contributions and salary sacrificed contributions are taxed at a low rate when they go into super. This is likely to be lower than your marginal tax rate.

Investment returns on a super pension account are not taxed, and when you turn 60, you won’t pay any tax on your pension income. Even if you are under age 60 you will get a tax rebate on your pension income.

Asset classes

and asset allocation

Asset classes

1. Cash

These include term securities, bank accounts and money markets. Generally with a short-term suggested investment timeframe, cash is considered relatively safe compared to other asset classes providing a stable return (interest) with low potential capital loss.

2. Fixed interest securities

These include investments such as bonds and debentures issued by government and semi-government bodies, banks and companies. With a general suggested investment timeframe of 1-3 years, fixed interest securities operate in similar way to loans. The investor buys a fixed interest security using cash and receives a regular interest payment from the issuer. Its value can fluctuate depending on the interest rate and on maturity the loan is paid back in cash. Generally providing a more consistent return than shares, but a lower rate of return.

3. Property

Generally investing in a property directly or a listed or unlisted property fund or property trust investing in properties in the industrial, commercial or hotel sector. Traded much like shares, listed property funds are listed on the ASX, while unlisted property is not as liquid. With a suggested investment timeframe of 3-5 years, generally property has been less volatile than shares.

4. Shares or equities (domestic or international)

These include various companies in various sectors which are generally traded on the stock exchange. Shareholders are paid a profit share in the form of dividends. The value of the share and the dividend amount paid usually depends on the company’s performance and changes in the economy as a whole. Generally shares involve greater short-term volatility with higher risk associated with shares than other asset classes. Each company is different, therefore each share has different risks associated with it. The suggested investment time frame is generally 5-7 years or more. Historically, shares have out-performed other assets over the long term.

Some investment options may also include alternative assets. These include a range of investments such as commodities, hedge funds and currencies and can be used to reduce risk and/or enhance returns. Hedge funds use non-traditional strategies and many aim to provide positive returns when traditional asset classes experience negative returns. Alternative assets are typically not traded on listed exchanges and therefore have lower liquidity compared to listed securities.

Asset allocation

Asset allocation is the strategy of dividing your investment portfolio across various asset classes to help minimise risk and potentially increase gains (diversification). Deciding on the investment strategy for your super is paramount. It is not a one-size-fits-all exercise. It is important to understand how your money is invested and that you are aware of and comfortable with the associated risks. Some things to consider when choosing the investment mix that is appropriate for you are your- Age and Income, Investment Experience, Risk Tolerance, Investment Objectives, Liquidity / Cash Requirements and Investment Timeframe. It is important to choose the appropriate investment options to help achieve your goals and that will allow you to sleep better at night.

All investments involve some degree of risk and volatility. Usually the higher the potential return on an investment, the higher the risk and volatility will be and vice versa. Generally, investors with a long time horizon and larger sums to invest may feel more comfortable with high risk, high return options as they have more time to recover from short-term losses. On the other hand investors with smaller sums and shorter time spans may feel more comfortable with low risk, low return allocations. They might have a greater need to preserve your capital and chose low risk investments.

To make the asset allocation process easier Super Prophets offers our Super Designed model portfolio options comprising of different proportions of asset classes and aimed at satisfying a particular level of investor risk tolerance. These options range from more conservative options- Protect and Protect Plus, our Balanced Options- Balanced and Balanced Plus, to our more growth- options- Build and Build Plus.

For more information on these investment options and how you can tailor your super to suit your needs, please refer to the Whole Super PDS, Additional Information Guide and Investment Guide.

Once you’ve chosen an appropriate asset allocation strategy, remember to conduct periodic reviews of your portfolio to ensure you’re maintaining your intended allocation and are still on track to your long-term investment goals.

Investment

risk profile

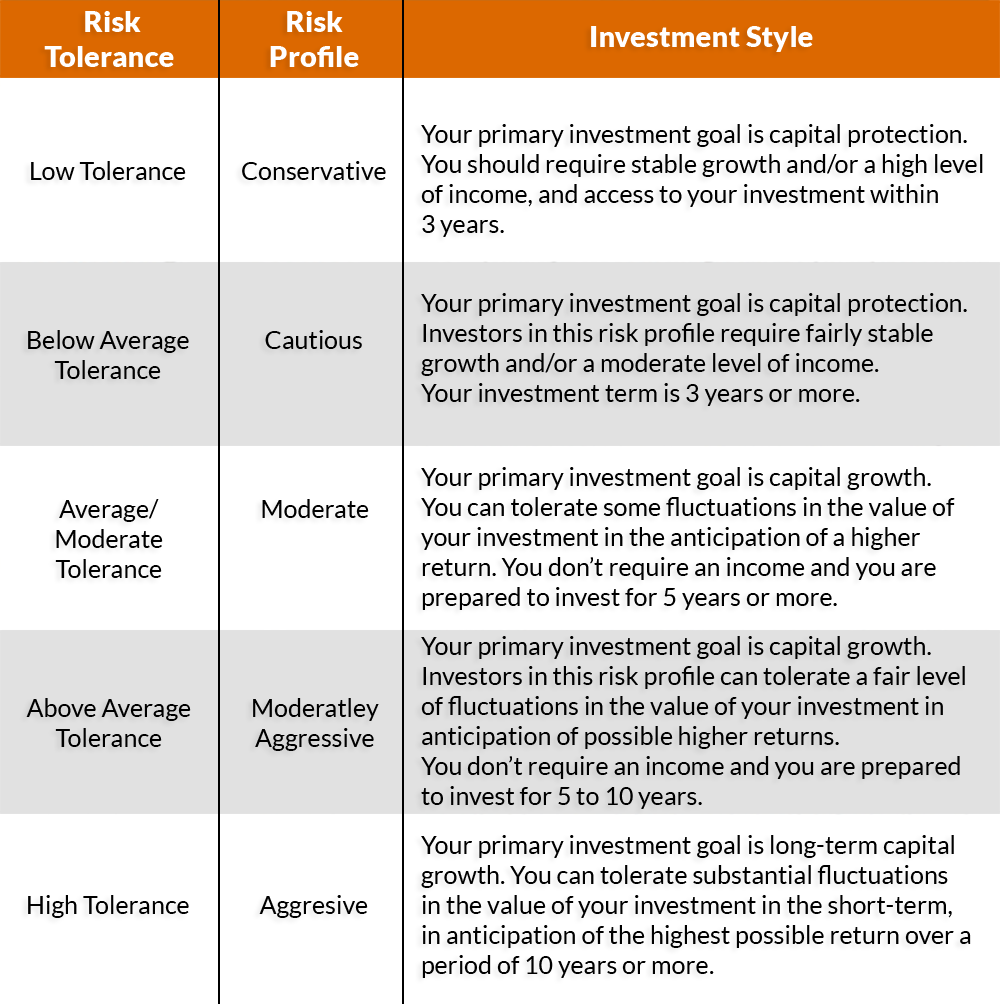

The risk quiz is a questionnaire that can be completed online in 15 minutes (found within the investment portal) and provides you with a suggested asset allocation of defensive and growth assets depending on which of the 5 possible risk groups you fit into (see below). Risk profiling is a system that has been widely used by leading financial advisers to help determine your personal risk tolerance. Each investor has a different attitude to risk. Understanding your risk profile will help you select investments that are appropriate for your personal risk tolerance and forms the foundation for making long term investment decisions.

What is a separately

managed account?

A separately managed account (SMA) is a portfolio of stocks managed by an investment professional. The underlying stocks are owned by the individual investor, unlike units in a managed fund. An SMA allows you to have exposure to the stock market whilst you have the comfort of knowing that your portfolio is being professionally managed. The allocation for each stock in the portfolio varies depending on the investment objective and focus for example, ASX top 20, Australian shares, property securities etc. and as a result the level of risk and return for each portfolio also varies. SMAs offer a range of Model Portfolios to choose from which are designed and constructed by investment specialists to help achieve the diverse investment needs of all account holders and allows investors to create a diversified portfolio of shares.

Main advantages of a separately managed account

- Investors retain most of the benefits and rights of investing in direct shares through beneficial ownership- the underlying stocks are owned, unlike units in a fund allowing the investor to transfer shares into and out of the fund via in-specie transfer and manage the tax position.

- Diversified portfolio- SMA investors can more effectively diversify their portfolio when choosing to invest in one or more of the model portfolios offered.

- Online consolidated reporting and administration- complete and up-to-date reports are available at any time and the SMA provider looks after all of the paperwork and administration on behalf of investors.

- Potentially lower brokerage costs

- The transparency, flexibility and tax advantages of SMAs are making them very popular.

Benefits of investing in Fat Prophets SMAs

| Benefits | Fat Prophets Managed Account (MAs) | Individually Managed Accounts (IMAs) | Pooled Investments (Managed Funds/LICs/ETFs) | Direct Shares |

| Access to professional managers | ||||

| Beneficial ownership of underlying shares | ||||

| Active portfolio management | ||||

| Highly transparent investment portfolio | ||||

| Institutional grade reporting platform | ||||

| In-specie transfers | N/A | |||

| Tax efferent | ||||

| Ability to monitor transactions | ||||

| Client Self Directed Top Up/Sell down | ||||

| Automatic corporate actions | ||||

| Well documented past performance | ||||

| Model portfolio structure | ||||

| Tailored Portfolio |

-

Managed by professionals- Using an extensively tested investment process with a contrarian approach, the Fat Prophets Investment Team, constantly monitors the model portfolios making changes as they are necessary. They have the information, resources, skills and experience to make decisions in a timely manner.

-

Flexible and liquid- Switch between models at any time.

-

Diversified- Invested in 30 – 40 high quality companies in a variety of industries. We use a careful stock selection method, purposeful portfolio weighting and strategic allocation in different sectors and cash.

-

Transparency- Use our online platform to track portfolio performance and tax reporting as well as to view management and transaction costs. Also receive constant updates on portfolios and our views on the market from the front line via our daily emails.

Our Core Features

There are countless reasons why our service is better than the rest, but here you can learn about why we’re different.

Education Centre

Learn how to read and anticipate the market

EDUCATION CENTRE

Learn how to read and anticipate the market with innovative regular content from Fat Prophets. Receive newsletters, emails and webinars designed to make you a better investor.

The Latest Research

We generate our own research to give our members

THE LATEST RESEARCH

We generate our own research to give our members a unique advantage in the marketplace. Join now to access up to the minute financial reports and recommendations.

Wealth Management

If you'd rather leave the decisions to an expert

WEALTH MANAGEMENT

If you’d rather leave the decisions to an expert, our dedicated Wealth Management Investment team can actively make your personal wealth grow to its full potential.

Invest Direct

fatPROPHETS Direct platform gives you the tools

Invest Direct

Super Prophets Invest Direct platform gives you the tools you need to research, invest wisely and gives you access to timely reporting, all in one place.

Managed Accounts

Allow the Fat Prophets investment team to do all the hard work

Managed Accounts

Allow the Fat Prophets investment team to do all the hard work for you by investing in a Fat Prophets Managed Account. Interested?

Full SMSF

We make it easy and cost effective

Full SMSF

We make it easy and cost effective for you to manage your retirement savings with a comprehensive online SMSF administration service.

Ready To See What's Next?

If you’re ready to get started, send us an email to info@fpdirect.com.au and someone from the Super Prophets team will be in touch shortly to help you get set up.

Or, if you’d like to speak directly with a Super Prophets team member call us on 1300 850 453.

General Advice warning

**The information provided does not take into account your financial situation, objectives or needs. Therefore you should consider the appropriateness of this information in regard to your own financial situation, objectives or needs. You should read the Product Disclosure Statement and consider this before making any investment decisions.